What Is Medigap Plan L?

Medigap Plan L is a Medicare Supplement plan that helps cover costs not included under Original Medicare’s Part A and Part B coverage. Original Medicare covers up to 80% of hospital and medical bills. Plan L helps fill some of the coverage gaps a person may have.

Medicare Supplement Plan L is a standardized plan. That means that the coverage provided remains the same across all insurance carriers that offer Medigap Plan L. No matter which insurance provider you choose, the coverage is the same from one to the next.

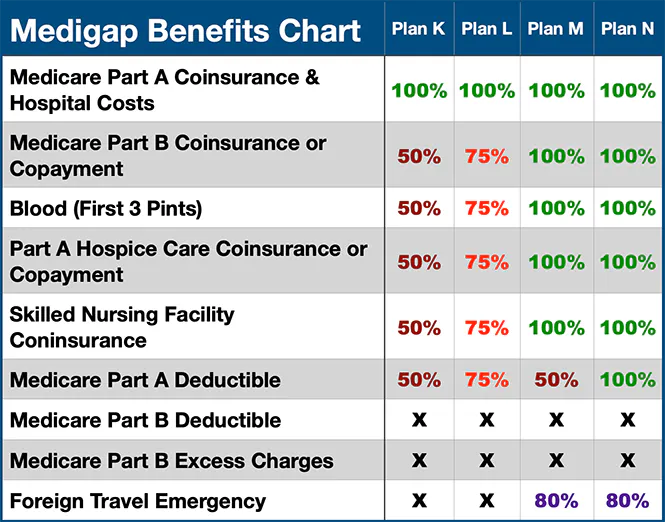

Medicare Plan L coverage helps provide 100% of Part A coinsurance and 75% of other benefits. In 2024, it has an out-of-pocket limit of $3,530.

Medicare Plan L Vs Plan K

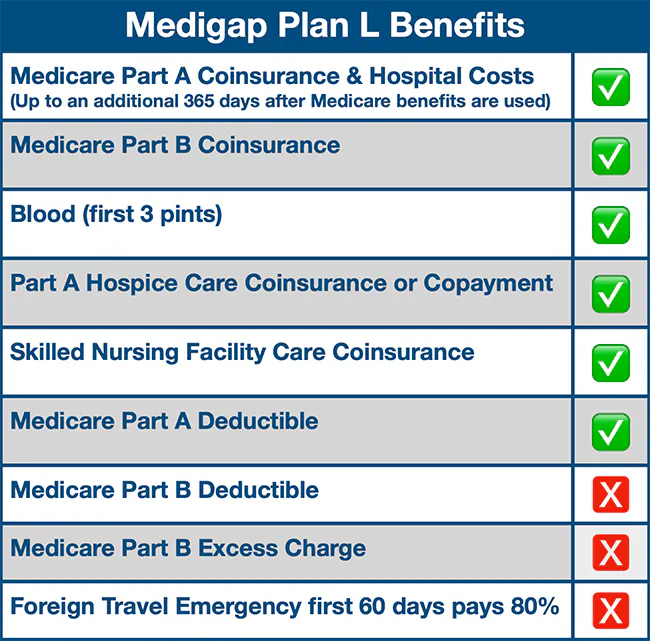

Medicare Supplement Plan L benefits Include:

Medicare Part A coinsurance and hospital costs (100%)

75% of Part A deductible

75% of Part A hospice care coinsurance or copayment

75% of blood for the first three pints and 100% after the first three pints

75% of skilled nursing care coinsurance

75% Part B coinsurance or copayment

What Medigap Plan L Does Not Cover?

Medicare Plan L coverage does have some limitations. It does not cover Part B deductibles or excess charges. In addition, it does not cover foreign travel emergencies. Medicare Plan L does not cover outpatient prescription drugs, dental, hearing, or vision coverage.

How Does Medicare Plan L Compare To Other Plans?

Medigap Plan L offers the same coverage benefits as Plan K, for the most part, but bumps up the amount of coverage from 50% (in Part K) to 75%. It also has a smaller out-of-pocket limit of $3,530.

You may notice a few additional differences when comparing Plan L to Plans M and N. Plans M and N do not have out-of-pocket limits. Additionally, Plan M pays 50% of Part A deductibles, and Part M and N pay 80% of foreign healthcare costs when traveling.

Who Is Eligible For Medicare Plan L?

To obtain any Medicare Supplement plan, you must first have Original Medicare. That means you need to first qualify to enroll in Medicare. If you have not signed up yet, you can learn how to apply for Medicare as a first step.You may be eligible for Medicare at age 65. If you do not decide to enroll when first eligible, you can sign up during the General Enrollment Period each year from Jan. 1 to March 31. Discover how and when you can defer Medicare enrollment and avoid late enrollment penalties and coverage gaps.Medicare Initial Enrollment Period

When you enroll in Medicare outside of your 7-month Initial Enrollment Period, Medicare Supplement insurance companies will ask you health questions. Moreover, Medigap insurance underwriting can deny coverage based on health conditions. Furthermore, the Medigap insurance provider may charge you more based on the underwriting interview. Thus, the best time to buy a Medigap plan is when you first become eligible.

How Can Senior Healthcare Direct Help You?

Let the experts at Senior Healthcare Direct support you in choosing the right supplement plan for your needs. We can help explain all of the complexities in Medicare and help you choose the right plan based on your circumstancesShop For Medigap Plan L Coverage

Learn how to save on your Medicare Supplement Plan L coverage. Medigap Plan L carriers offer the same Medicare Supplement plan benefits. However, carriers may offer Medicare Plan L coverage at different prices. Senior Healthcare Direct can shop carriers for you so you get the most cost-effective price. Call 1-833-463-3262 to speak with a licensed agentSources

External sources include:YM05102301