Enrollees of Medicare Supplement plans show steady growth in recent years. Between 2017 and 2021 Medigap enrollees have grown from 35% to 41% , and further growth is likely.

Discover who’s eligible for Plan F and how switching to Plan G could save you money.

Medigap Plan FAQs

Who is eligible to buy Plan F?

Medicare beneficiaries who already had Plan F before January 1, 2020, can keep their plan. However, beneficiaries new to Medicare after January 1, 2020, are not eligible to buy Plan F.

What’s the difference between Plan F and Plan G?

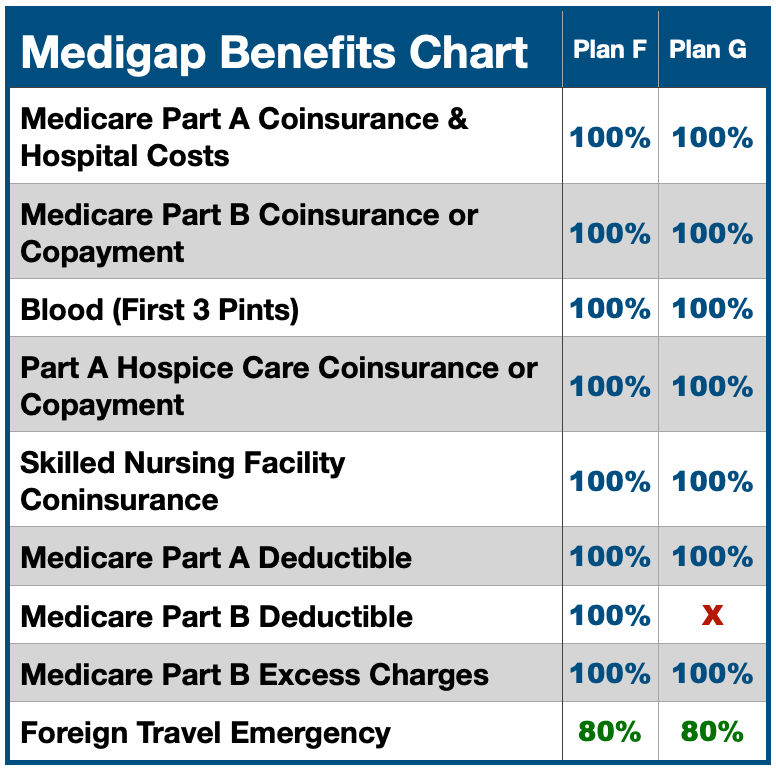

Comparing Medigap Plan F to Plan G, the only coverage difference is the Part B deductible. Plan F covers the $226 Part B deductible in 2023. However, Plan G and all Medigap plans sold to everyone who became eligible for Medicare on or after January 1, 2020, do not cover the Part B deductible.

Why switch from Plan F to Plan G?

You could save money by switching from Plan F to Plan G. Comparing the annual cost (premiums and deductible) of Plan F vs Plan G, you may discover that Plan G costs you less.

Benefits of Medicare Plan F vs Plan G

As shown in the Medigap Benefits Chart, Plan F and G include the same coverage benefits except for the Part B deductible. Under Medicare Supplement Plan G, you pay the Part B deductible of $226 in 2023.

Which Medigap Plan is a Better Deal for You?

In 2023, the monthly cost of Medicare Part B deductible is ($226 / 12 months) $18.83. So, if the monthly premium for Plan F is more expensive than Plan G by $18.83, then Plan G is the better deal for you.

Senior Healthcare Direct can help you find the right Medicare Supplement plan. Call 1-833-463-3262, TTY 711 to speak with a licensed agent or get your quote.

YM06012301